In today’s ever-changing economic landscape, it’s only natural to ask: what are the chances of a market crash? This question has been on the minds of many investors for years and there is no simple answer. Fortunately, there is an indicator that can help gauge the likelihood of a market crash: the Volatility Index (VIX).

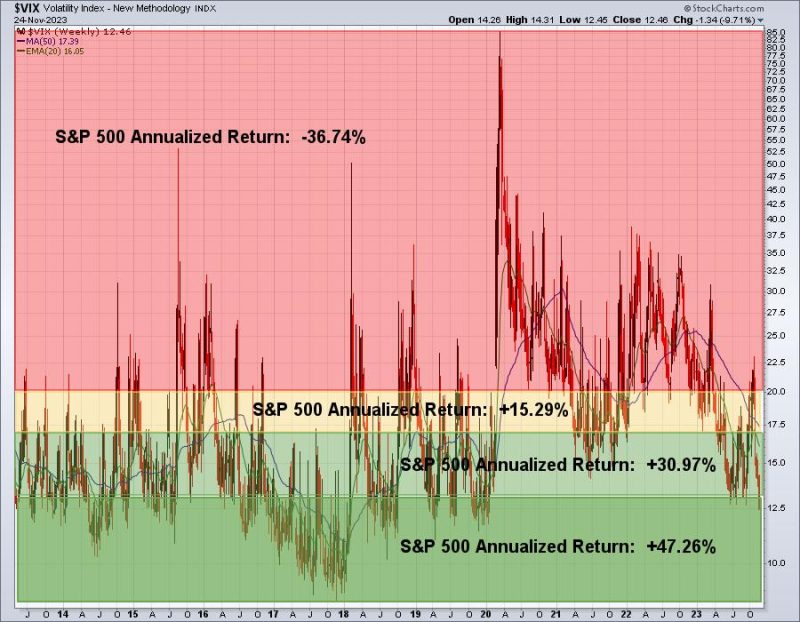

The VIX is an index compiled by the Chicago Board Options Exchange (CBOE) that measures the near-term volatility in the U.S. stock markets. It is seen as the fear gauge of the market, measuring the degree to which investors are expecting sharp price swings to occur in the near future. The higher the VIX, the greater the likelihood that a market crash is imminent.

In the case of today’s stock market, the VIX is currently at a low level of around 13. This suggests that there are very slim chances of a market crash following in the near future. In fact, the VIX readings have stayed at relatively low levels over the last several months, indicating that investors have been rather complacent in terms of the potential for a sudden selloff.

This has been good news for investors who are looking to take advantage of the bull market run that has lifted equities to record highs throughout 2019. However, this doesn’t mean investors should become complacent and ignore the need for careful risk management. It is always important to keep an eye on the VIX to ensure that any sudden increase in volatility is addressed quickly.

In conclusion, the currently low levels of the VIX suggest that there is currently very little chance of a market crash occurring in the near future. However, investors should stay vigilant and be sure to manage their risk carefully to ensure they are not blindsided by a sudden selloff.