Intermediate-Term Participation Levels Are Very Overbought and They Are Weak Long-Term

It has become common knowledge that traders should always pay attention to markets’ gauges of sentiment. The most important factor to consider when analyzing stock market sentiment is the participation level of intermediate and long-term traders. If participation levels are significantly overbought, it could indicate the potential for a bearish correction.

The American Stock Exchange (AMEX) and the New York Stock Exchange (NYSE) publish daily measures of volume and open interest on their web sites. Here, we’ll take a look at intermediate and long-term participation levels to gauge the current market sentiment.

Compared to long-term traders, intermediate-term traders can be viewed as more active, as they position themselves for short-term trades while also placing orders and applying strategies on intermediate-term timeframe. In the United States, the Russell 2000 index is viewed as a proxy for the small-cap universe. The Russell 2000 index is often used by traders as a measure of intermediate-term participation levels.

The Russell 2000 index compares preservation buys and sells to its historical average. It is possible to verify if intermediate-term participation levels are abnormally overbought or oversold, based on the measure of preservation buys and sells. The current reading indicates that the Russell 2000 index is +17.1, meaning that intermediate-term traders are abnormally overbought.

It is common knowledge that the more overbought a market becomes, the greater the probability of a selloff. This makes the current reading very concerning, as the Russell 2000 index is at its highest level in four years.

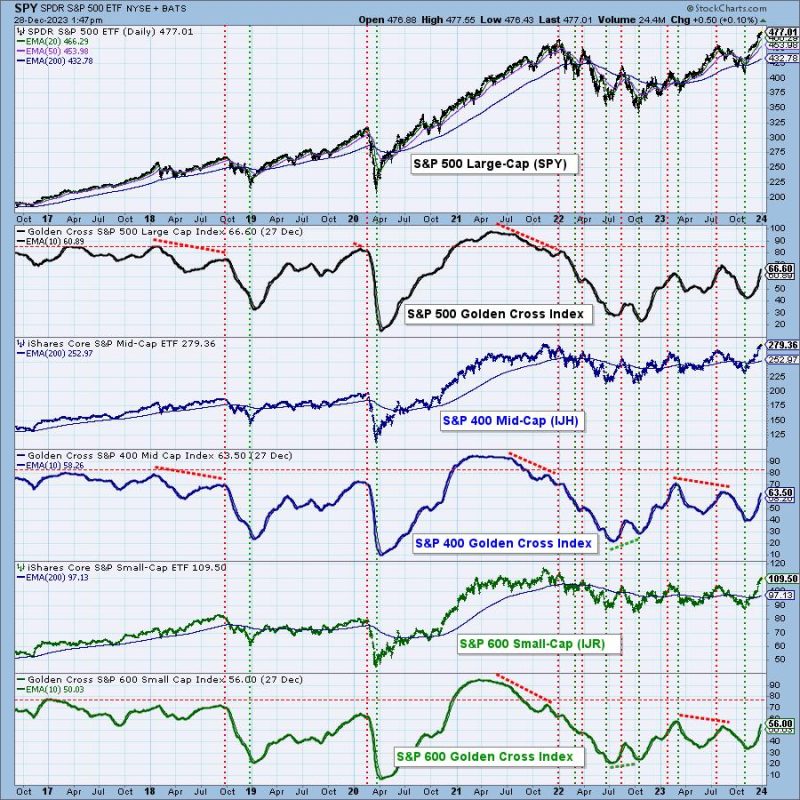

Long-term participation levels are also indicators of market sentiment. The S&P 500 index is used as an indicator for long-term participation levels. Compared to the Russell 2000 index, the S&P 500 index shows a significant weakness in terms of long-term participation levels. In the past five years, the average long-term participation level for the S&P 500 index has been -10.2. Currently, the index is -17.4, indicating a significant loss of long-term participation.

It appears that intermediate-term traders are very overbought, but long-term traders are significantly weaker. In either case, it is wise to be cautious ahead of a potential market selloff.

It’s important to remember that in markets, it’s not a trend until confirmed otherwise. It’s necessary to pay attention to intermediate-term and long-term participation levels to get an idea of what the markets are doing. If participation levels are becoming overbought, it’s wise to take a more conservative stance and add caution.