In the realm of trading and investing, effectively managing risk and defining trends are key components to achieving success. One popular tool that many traders use for this purpose is the Average True Range (ATR) trailing stop. The ATR trailing stop serves as a dynamic indicator that adjusts based on market volatility, offering a flexible approach to managing trades and identifying trends.

Understanding how the ATR trailing stop works is essential for traders looking to enhance their risk management strategy. By calculating the average true range of price movements over a specified period, the ATR gives insight into the volatility of the market. This information is then used to set a trailing stop that moves in tandem with price fluctuations, providing a buffer against adverse movements while allowing for potential gains to accumulate.

When implementing the ATR trailing stop, it is important to consider how it can be used to manage trades effectively. By placing the trailing stop at a certain distance below (for long positions) or above (for short positions) the price, traders can protect their profits and limit potential losses. As the price moves in favor of the trade, the trailing stop adjusts accordingly, locking in gains and potentially allowing for further upside potential.

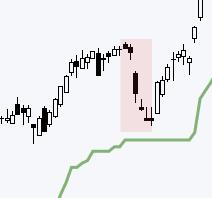

Moreover, the ATR trailing stop can also be a valuable tool for defining trends in the market. By observing the distance between the price and the trailing stop, traders can gauge the strength of a trend. For instance, a wide gap between the price and the trailing stop indicates a strong trend, while a narrow gap suggests a potential reversal or consolidation phase. This information can help traders make informed decisions about when to enter or exit a position based on the prevailing market conditions.

In conclusion, the ATR trailing stop is a versatile tool that can assist traders in managing their trades and identifying trends effectively. By harnessing the power of the ATR indicator, traders can improve their risk management strategy, protect their profits, and capitalize on trend opportunities in the market. Whether you are a novice trader or a seasoned investor, incorporating the ATR trailing stop into your trading toolkit can help you navigate the complexities of the financial markets with confidence and precision.