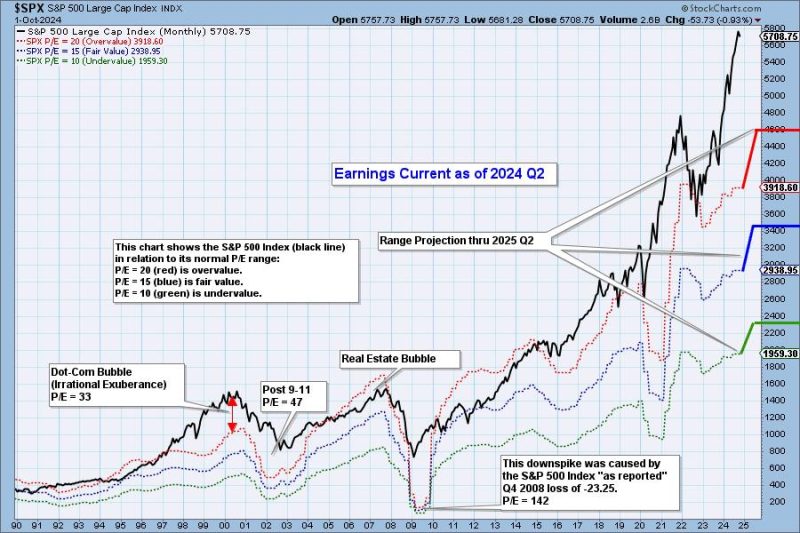

The article you shared delves into the evaluation of the market’s overvaluation based on the earnings reported in the second quarter of 2024. The discussion revolves around the potential risks and considerations for investors amidst the perceived overvaluation of the market.

Key Takeaways from the Analysis

1. Market Performance: The analysis highlights that while the market continues to flourish, there are concerns about the sustainability of this growth, particularly considering the high valuations observed. The article emphasizes the need for investors to exercise caution in such a scenario.

2. Earnings Report: The article references the earnings report released in the second quarter of 2024 as a crucial point of evaluation for the market’s valuation. It suggests that despite positive earnings figures, the market may still be overvalued based on certain metrics and comparisons.

3. Sector Variability: Another significant aspect touched upon in the analysis is the variability in performance across different market sectors. While some sectors may exhibit strong growth potential, others could face challenges or overvaluation concerns, reinforcing the need for diversified investment strategies.

4. Technical Indicators: The article suggests that technical indicators can provide valuable insights into market trends and potential corrections. By closely monitoring indicators such as market breadth, volatility levels, and price-to-earnings ratios, investors can make more informed decisions in navigating the uncertainties of an overvalued market.

5. Investor Strategy: In light of the market’s perceived overvaluation, the article recommends that investors adopt a balanced approach to managing their portfolios. Diversification, risk assessment, and periodic review of investment strategies are cited as essential components of a prudent approach to safeguarding investments in an overheated market.

6. Long-Term Perspective: The analysis underscores the importance of maintaining a long-term perspective amid short-term market fluctuations. While immediate concerns about overvaluation may warrant caution, the article suggests that a focus on fundamental analysis and investment objectives can guide investors through uncertain market conditions.

In conclusion, the article provides a detailed examination of the market’s overvaluation and offers insights into the implications for investors. By recognizing the challenges posed by high market valuations and implementing strategic investment practices, investors can navigate the complexities of an overvalued market more effectively and protect their assets in the long run.