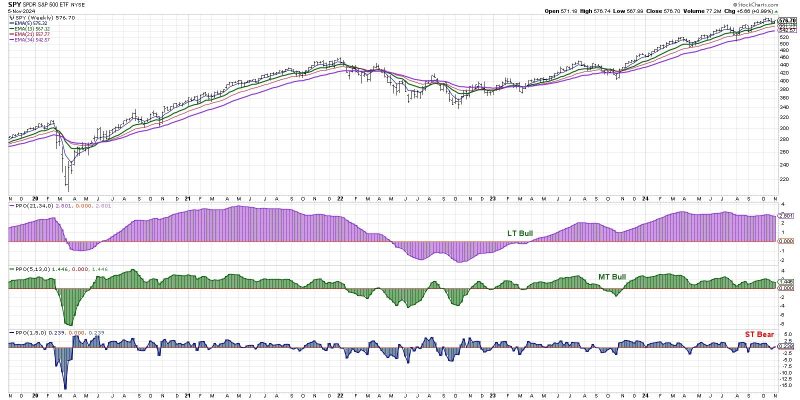

The recent market movements have sent short-term bearish signals, hinting at potential uncertainties ahead. As investors gear up for a news-heavy week, volatility is on the rise across various asset classes. The impact of upcoming events on global markets remains uncertain, leading to cautious sentiment prevailing among traders.

Geopolitical tensions have been a key driver behind the market fluctuations, with ongoing conflicts and shifting alliances creating a volatile environment. The upcoming news events, including economic data releases, central bank announcements, and geopolitical developments, are expected to further influence market sentiment.

Central bank decisions, such as interest rate changes or monetary policy updates, can have a significant impact on market movements. Investors are closely monitoring these announcements for clues on future policy direction and economic outlook. Any unexpected shifts in central bank strategies could trigger sharp market reactions.

Economic data releases, such as GDP growth figures, employment reports, and inflation data, provide insights into the health of economies. Positive or negative surprises in these indicators can lead to market volatility as investors adjust their expectations and positions accordingly. Traders will be closely watching these releases for signals on economic recovery and future growth prospects.

Geopolitical developments, including trade tensions, diplomatic relations, and conflicts, have the potential to disrupt global markets. Uncertainties surrounding geopolitical events can create sudden market moves and impact investor confidence. As tensions escalate or de-escalate, markets react swiftly to reflect changing risk perceptions.

Overall, the convergence of these factors in a news-heavy week could intensify market volatility and lead to short-term bearish signals. Investors are advised to stay informed, exercise caution, and closely monitor market developments to navigate through the uncertainties ahead. As the market braces for a turbulent week, strategic planning and risk management are crucial for traders to navigate through the challenging landscape of global markets.