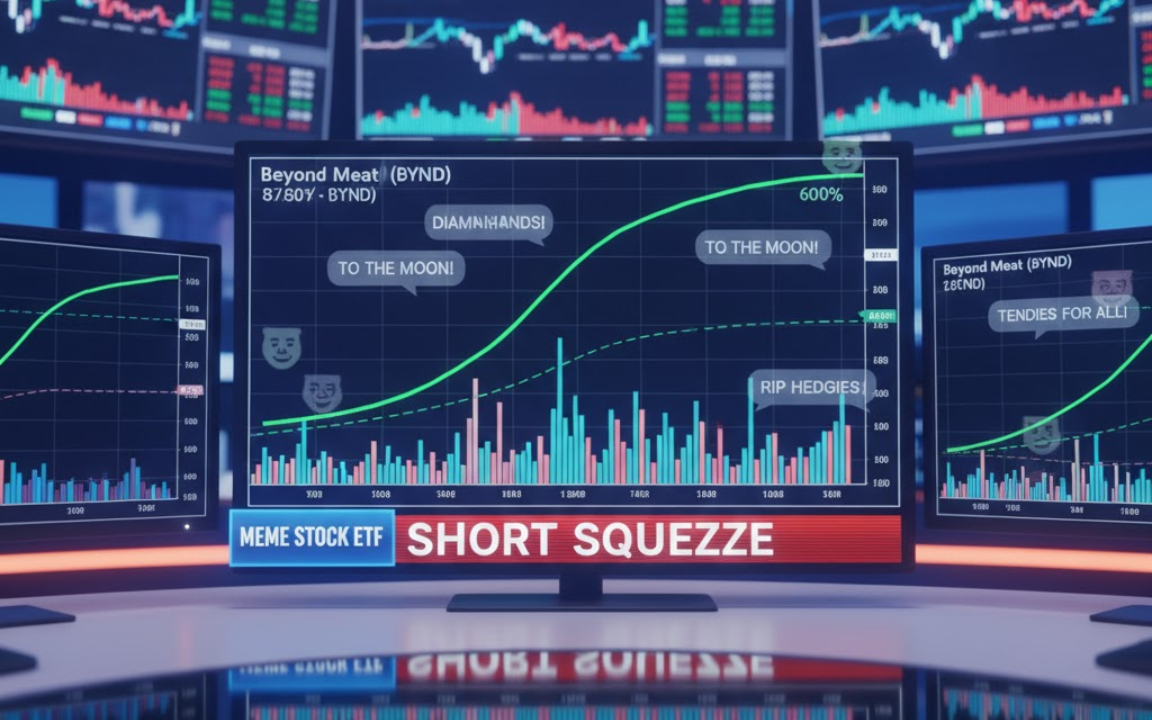

Beyond Meat stock (NASDAQ:BYND) surged nearly 600% over three trading sessions from October 17 to October 21, 2025, climbing from an all-time low of 50 cents to $3.62 and capturing renewed attention across retail trading platforms.

The dramatic rebound came just days after the plant-based meat producer hit record lows following a debt-for-equity swap that diluted shareholders by more than 300%.

The surge raises critical questions about whether the rally reflects improving fundamentals or speculative momentum driven by short covering and social media enthusiasm.

With more than 63% of the float sold short and trading volumes exceeding 1.2 billion shares on October 21 alone, the move exhibited classic meme-stock dynamics rather than a fundamental shift in the company’s trajectory.

Beyond Meat stock: What triggered the massive rally

The spike was driven by a confluence of technical and sentiment-based catalysts rather than operational improvements.

On October 20, Beyond Meat was added to the Roundhill Meme Stock ETF, a fund that tracks retail-driven stocks with high social media activity and short interest.

The inclusion brought institutional flows and heightened visibility among momentum traders, amplifying buying pressure.

On October 21, the company announced expanded distribution at over 2,000 Walmart stores nationwide for its Beyond Burger 6-pack and Beyond Chicken Pieces, providing a tangible business development that coincided with the speculative rally.

Market microstructure played a central role in the surge. Beyond Meat had 39.59 million shares sold short as of late September, representing 63.13% of its float, a 26.65% increase from the prior month.

Short interest levels above 60% created conditions for a violent squeeze, as bearish investors rushed to cover positions amid rising prices.

Options activity spiked to 15 times normal volume on October 21, with call options accounting for 74.49% of the day’s 2.53 million contracts traded.

Borrow costs, which had reached triple-digit annual rates in mid-October, made maintaining short positions prohibitively expensive for many traders.

Social media campaigns amplified the momentum.

Dubai-based trader Dimitri Semenikhin, known as “Capybara Stocks,” disclosed purchasing approximately 4% of the company’s outstanding shares and posted a bullish thesis on Reddit and YouTube, arguing that the recent debt swap had eliminated bankruptcy risk.

Real rally or just hype?

On paper, this rally doesn’t look like it’s coming from better business performance. If anything, the fundamentals still look weak.

In the second quarter of 2025, Beyond Meat brought in $75 million in net revenue, almost 20% less than the year before, and gross margins slipped to 11.5% from 14.7% as volumes kept falling and the company exited China.

It also posted a $29.2 million net loss and an adjusted EBITDA loss of $22.1 million, underscoring the broader slowdown in the plant-based meat category, both in US retail and international foodservice.

The company even pulled its full-year guidance and said it would lay off 6% of staff, a move that points to mounting pressure.

Revenues have slid from $465 million in 2021 to $326 million in 2024, while the balance sheet is stretched thin: roughly $1.2 billion in debt versus just $103.5 million in cash.

Wall Street isn’t buying the turnaround story either.

Out of eight analysts that still cover the stock, five rate it a “sell” or “strong sell,” and the median price target is $2.27, more than a third below the October 21 close of $3.62.

TD Cowen recently cut its target even further, to $0.80 from $2.00 after the debt swap, warning the business faces an “existential threat” if nothing changes.

The post How did Beyond Meat stock gain 600% in 72 hours: real rally or hype? appeared first on Invezz