The world of cryptocurrency has seen a major surge in interest in the past couple of years, and Bitcoin is at the forefront of it all. The introduction of Bitcoin futures contracts has amplified the amount of activity from investors within the crypto space, and the open interest in these contactsw has skyrocketed in recent months.

To put it simply, the “open interest” of any given futures contract is the total number of contracts that have not yet been settled. As the open interest in a futures contracts increases, it usually means that more traders are actively opening positions in the contract and are interested in trading it.

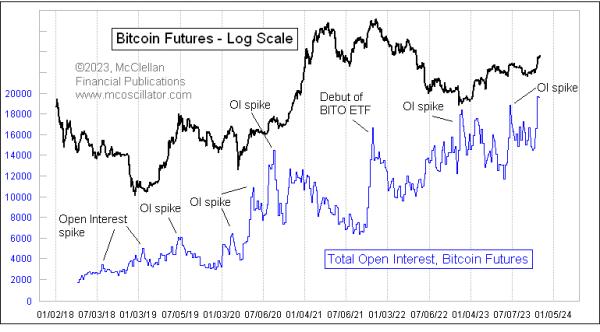

As of this week, the open interest in the Bitcoin futures contracts listed on the Chicago Mercantile Exchange (CME) has spiked to all-time highs. This marks a major milestone for the cryptocurrency, as the open interest in Bitcoin futures contracts is now higher than it ever was for gold futures.

The current open interest in CME Bitcoin futures stands at an impressive 2.4 million contracts, which is more than double what it was at the start of the year. The open interest in other crypto futures contracts is also doing well, with more than 550,000 contracts now open on the Chicago Board Options Exchange (CBOE).

This explosive rise in Bitcoin futures open interest is a testament to the growing popularity of the asset. As more and more investors become interested in Bitcoin, the demand for futures contracts has surged, resulting in higher open interest.

Interestingly, the open interest in Bitcoin futures is concentrated on the contracts with longer expiration dates. This means that investors are expecting the price of Bitcoin to stay strong in the near future, as evidenced by their willingness to hold the contracts even weeks before expiration.

It remains to be seen how this surge in open interest will impact Bitcoin prices in the coming weeks. For now, investors should keep a close eye on the open interest numbers, as they can be a powerful indicator of future price action.