Diverging Tails on This Relative Rotation Graph Unveil Trading Opportunities

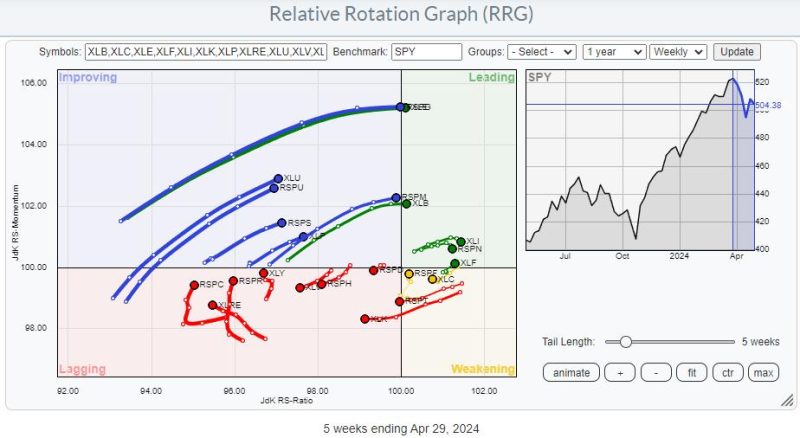

The Relative Rotation Graph (RRG) is a powerful tool used by traders and analysts to visualize the relative strength and momentum of various financial instruments or asset classes within a given universe. By plotting each asset as a data point on a chart, the RRG helps traders identify potential trading opportunities based on the direction and speed at which these assets are moving relative to a benchmark.

In the RRG provided, we observe two distinct tails diverging from the center, indicating interesting trading opportunities within the universe of assets being analyzed. Let’s delve deeper into these diverging tails and explore the implications for traders seeking to capitalize on these trends.

The first tail, labeled Tail A, represents assets that are moving towards the leading quadrant of the RRG. These assets exhibit strong relative strength and momentum compared to the benchmark and are likely to outperform in the near term. Traders looking to capitalize on this trend may consider allocating capital to assets within Tail A, anticipating further price appreciation and potential trading opportunities on the long side.

On the other hand, we have Tail B, comprising assets that are moving towards the lagging quadrant of the RRG. These assets are exhibiting weak relative strength and momentum compared to the benchmark and are more likely to underperform in the coming period. Traders keen on shorting opportunities or defensive positioning may find assets within Tail B appealing, given the potential for further price depreciation and the possibility of profiting from downside moves.

By closely monitoring the trajectories of these diverging tails on the RRG, traders can stay ahead of the curve and position themselves strategically to capitalize on unfolding market trends. It is essential to combine RRG analysis with other technical and fundamental indicators to confirm trading signals and manage risk effectively.

In conclusion, the RRG provides a visually compelling way to identify trading opportunities based on relative strength and momentum dynamics within a universe of assets. By analyzing diverging tails on the RRG chart, traders can gain valuable insights into potential trading setups and make informed decisions to optimize their trading strategies. Remember, staying nimble and adaptive in response to changing market conditions is key to successful trading in today’s dynamic financial landscape.