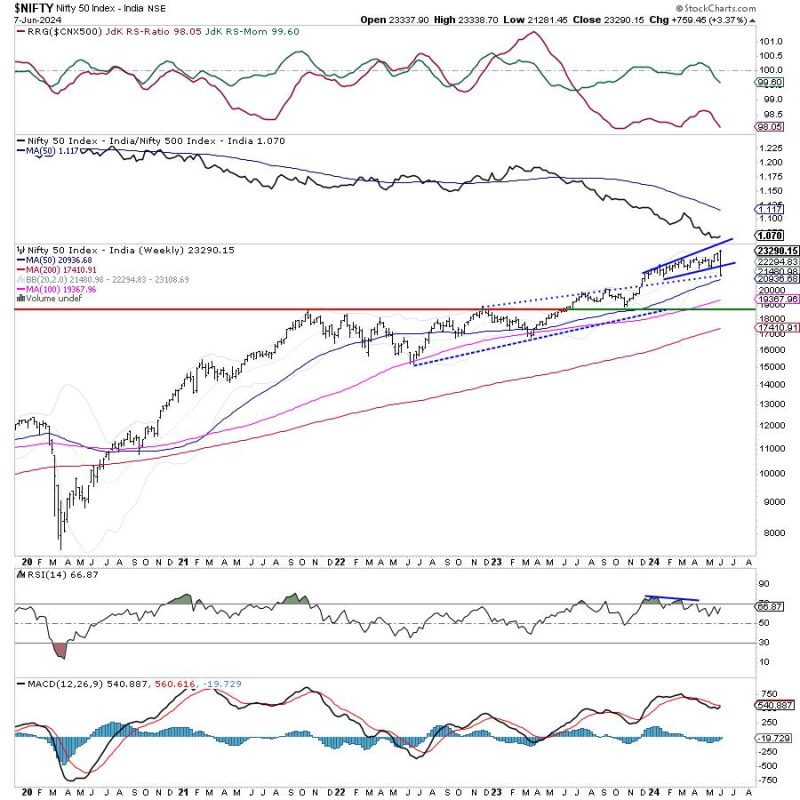

As we delve into the dynamics of the stock market, it becomes evident that despite recent pullbacks, the market breadth remains a cause for concern. The Nifty index, a prominent indicator of the Indian stock market, continues to remain susceptible to retracement. This scenario raises various questions and prompts investors to reassess their strategies in an ever-evolving financial landscape.

The concept of market breadth denotes the overall health and strength of the market by analyzing the number of stocks advancing versus declining. A market with strong breadth indicates that a significant portion of stocks are participating in the upward movement, reflecting a broad-based rally. On the contrary, weak breadth suggests that only a limited number of stocks are driving the market higher, signifying a narrower and potentially fragile rally.

In the current scenario, despite the Nifty showing resilience and maintaining its position, the underlying market breadth leaves a lot to be desired. While certain sectors may be performing well, a deeper analysis reveals that the broader market participation is lacking. This disparity creates a sense of caution among investors, as a market rally driven by only a few stocks or sectors may not be sustainable in the long run.

The vulnerability of the Nifty index to retracement further adds to the uncertainty surrounding market dynamics. Retracement refers to a temporary reversal in the price of an asset within a larger trend. In the case of the Nifty, the potential for retracement implies that the gains made during the recent uptrend could be at risk of being retraced, leading to a pullback in the index.

For investors navigating these uncertain waters, it becomes imperative to adopt a cautious and diversified approach towards their investment portfolios. Diversification, the age-old strategy of spreading investments across different asset classes and sectors, can help mitigate risks associated with market fluctuations and sector-specific downturns.

Moreover, staying informed and abreast of market developments, trends, and indicators is crucial in making informed investment decisions. By keeping a close eye on market breadth indicators, technical analysis, and macroeconomic factors, investors can gain valuable insights into the underlying health of the market and adjust their strategies accordingly.

In conclusion, while the Nifty index continues to hold its ground, the concerns surrounding market breadth and potential retracement warrant a vigilant approach from investors. By focusing on diversification, thorough research, and a disciplined investment strategy, investors can navigate through market uncertainties and position themselves for long-term success in the ever-changing landscape of the stock market.