Sector Rotation Model Flashes Warning Signals

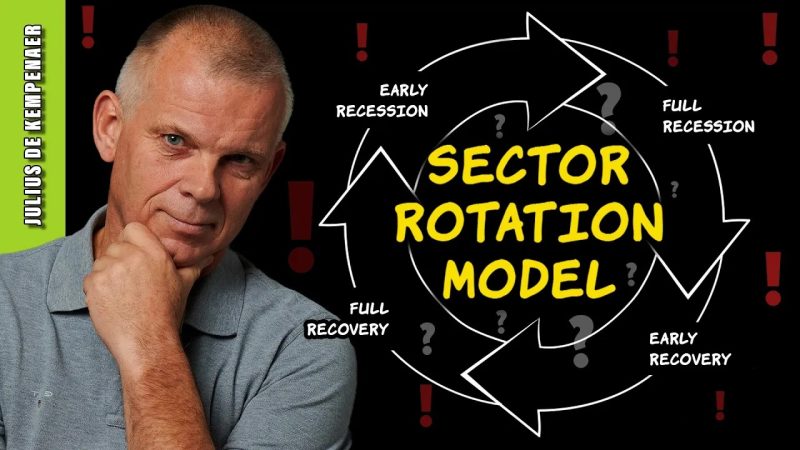

Understanding the dynamics of the market is paramount for any investor or trader aiming to make informed decisions. One tool that analysts frequently use is the sector rotation model, which tracks the relative strength of different sectors within the market. By interpreting these signals, investors can gain insights into where the market may be heading and adjust their portfolios accordingly. However, as with any method, it is crucial to exercise caution and consider various factors before making significant investment decisions based on these signals.

The sector rotation model essentially revolves around the concept that different sectors outperform or underperform the broader market at different points in the economic cycle. By analyzing these rotations, investors can potentially identify opportunities to capitalize on the market trends and position themselves for success. However, relying too heavily on this model without considering other factors can be risky, as the market is influenced by a multitude of variables, many of which are beyond the scope of a sector rotation model.

In recent times, the sector rotation model has flashed warning signals, hinting at potential shifts in the market dynamics. This could be attributed to various factors such as economic indicators, geopolitical events, or changes in investor sentiment. For instance, if the model suggests that defensive sectors like utilities and consumer staples are gaining strength while high-growth sectors like technology and healthcare are losing momentum, it could indicate a shift towards a more risk-averse market sentiment.

It is important for investors to approach these warning signals with caution and not make impulsive decisions based solely on the sector rotation model. While it can provide valuable insights, it is essential to supplement this analysis with a comprehensive understanding of the broader market trends, economic fundamentals, and company-specific factors. Additionally, incorporating risk management strategies and diversification techniques can help mitigate potential losses in case the market moves in an unexpected direction.

Another key consideration when interpreting warning signals from the sector rotation model is to differentiate between short-term fluctuations and longer-term trends. Markets are inherently volatile, and short-term movements can sometimes be noise rather than genuine shifts in underlying fundamentals. By maintaining a long-term perspective and not reacting hastily to every signal, investors can avoid making rash decisions that may harm their portfolios in the long run.

In conclusion, while the sector rotation model can be a valuable tool for understanding market dynamics, investors should exercise caution when interpreting warning signals from this model. It is essential to consider multiple factors, maintain a long-term perspective, and utilize risk management strategies to navigate the complexities of the market successfully. By approaching sector rotation signals with a well-rounded and informed strategy, investors can make more sound investment decisions and potentially enhance their long-term returns.