In the fast-paced world of stock markets, investors are always on the lookout for signs of potential disruptions to established trends. The Nifty index has been on a positive trajectory for some time now, but recent developments suggest that a shift may be on the horizon. It is essential for investors to exercise caution and remain vigilant in order to navigate any potential changes in market dynamics successfully.

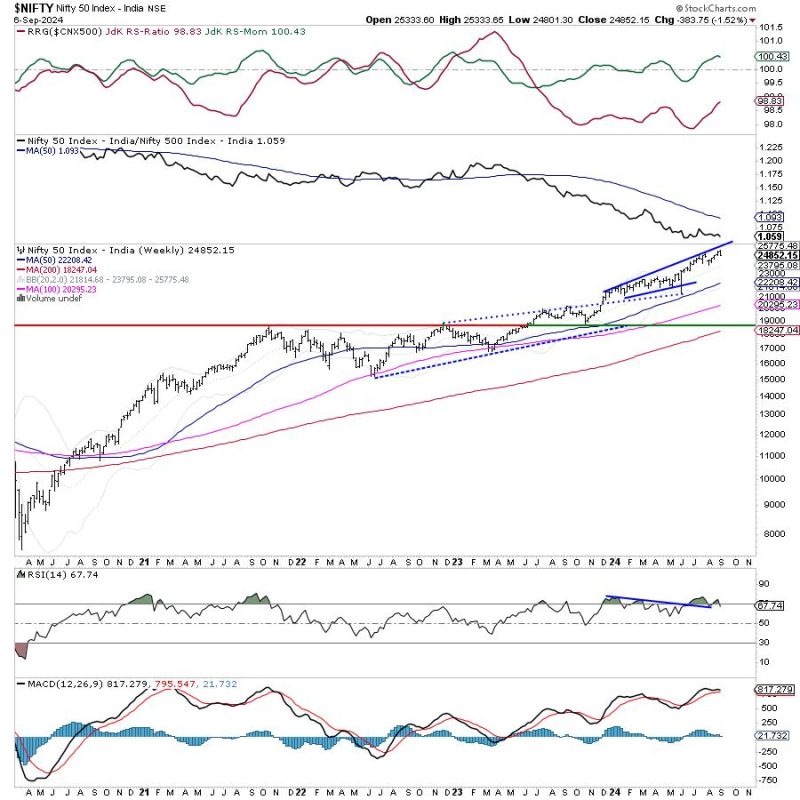

Technical analysis plays a crucial role in identifying early signs of shifting trends. As per the analysis presented in the article, the Nifty index is displaying indicators that point towards a possible disruption of the current uptrend. The formation of a ‘Bearish Engulfing’ pattern on the charts is a red flag for investors, signaling a potential reversal in the market sentiment. Combined with other technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), the outlook remains cautiously bearish.

Market sentiment plays an equally important role in determining the direction of stock prices. With global uncertainties and economic indicators showing mixed signals, investor confidence may be at risk. Factors such as geopolitical tensions, inflation concerns, and economic recovery post-pandemic can all influence market sentiment and trigger a shift in trend. It is crucial for investors to stay informed about such developments and adjust their strategies accordingly.

Risk management is paramount in times of uncertainty. As the market shows signs of a potential disruption to the uptrend, investors must review their portfolios and consider adjusting their exposure to risky assets. Diversification and asset allocation strategies can help mitigate losses during market downturns. Setting stop-loss orders and having a well-defined exit plan can also protect investors from significant downside risk.

In conclusion, the Nifty index is displaying early signs of a likely disruption of the uptrend. Investors should approach the market with caution, keeping a close eye on technical indicators, market sentiment, and risk management strategies. By staying informed and proactive, investors can navigate uncertain market conditions and protect their portfolios from potential losses.