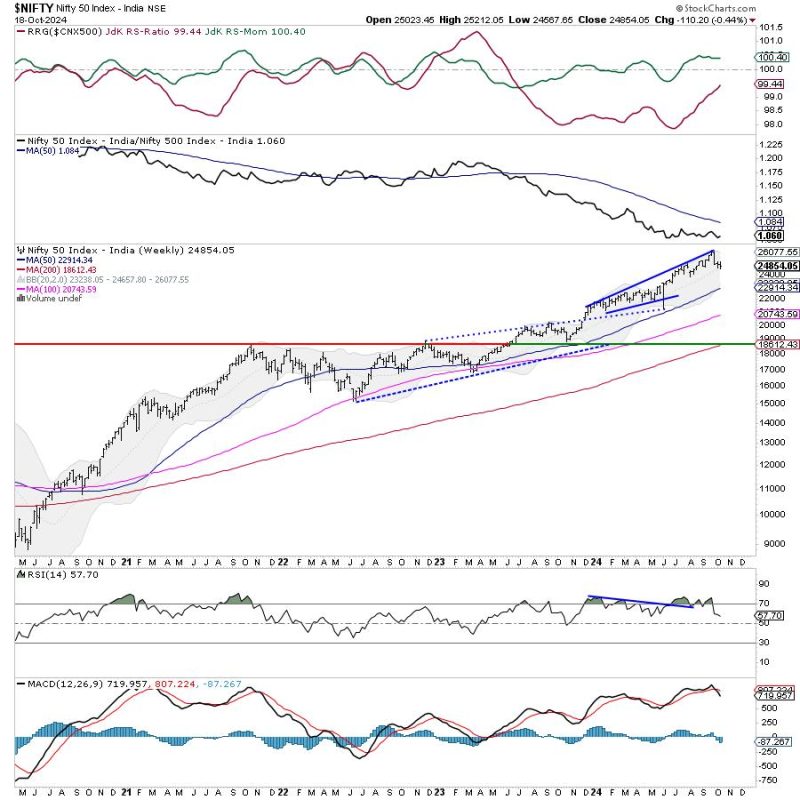

The article discusses the potential movement of the Nifty index in the upcoming week, focusing on key levels that could trigger trending moves. The Nifty index is a major stock market index in India that is widely followed by investors and traders. The analysis suggests that the Nifty may remain within a range in the absence of significant developments but could experience trending moves if specific levels are breached.

The article emphasizes the importance of technical analysis in predicting market movements and signals. By examining the previous week’s trading patterns and price action, analysts can identify crucial levels that could act as support or resistance. This information is invaluable for traders seeking to make informed decisions and capitalize on potential market movements.

Furthermore, the article highlights the significance of monitoring global market trends and economic indicators that could influence the Nifty index’s performance. Factors such as interest rates, economic data releases, and geopolitical events can all impact market sentiment and drive price action.

The article advises traders to keep a close watch on key levels, such as support and resistance zones, as they provide valuable insights into market dynamics. Breakouts above resistance or below support levels could indicate the start of a new trend, offering lucrative trading opportunities for savvy investors.

In conclusion, the article underscores the importance of staying informed and proactive in the ever-changing stock market environment. By utilizing technical analysis, monitoring key levels, and staying abreast of relevant market developments, traders can position themselves for success in the Nifty index and capitalize on potential trending moves.