In the realm of financial markets, stock behemoths like the Nifty have long been subjects of intense scrutiny and speculation. Navigating the turbulence of market trends and investor sentiments, the Nifty often finds itself at the mercy of a myriad of factors that can influence its trajectory. As we delve into the week ahead, a stable start seems to be on the horizon for the Nifty, but lurking beneath the surface is the looming threat of continued selling pressure at higher levels.

Market analysts and experts have long grappled with the enigmatic nature of the Nifty, attempting to decipher the intricate web of economic indicators, global events, and investor behavior that shape its movements. The upcoming week presents a crucial juncture for the Nifty as it treads the fine line between stability and vulnerability.

While a stable start may offer a semblance of reassurance to investors, the shadow of selling pressure at higher levels looms large over the market. The Nifty may find itself grappling with the intricacies of supply and demand dynamics, as investors weigh the risks and rewards of holding onto their positions in the face of potential headwinds.

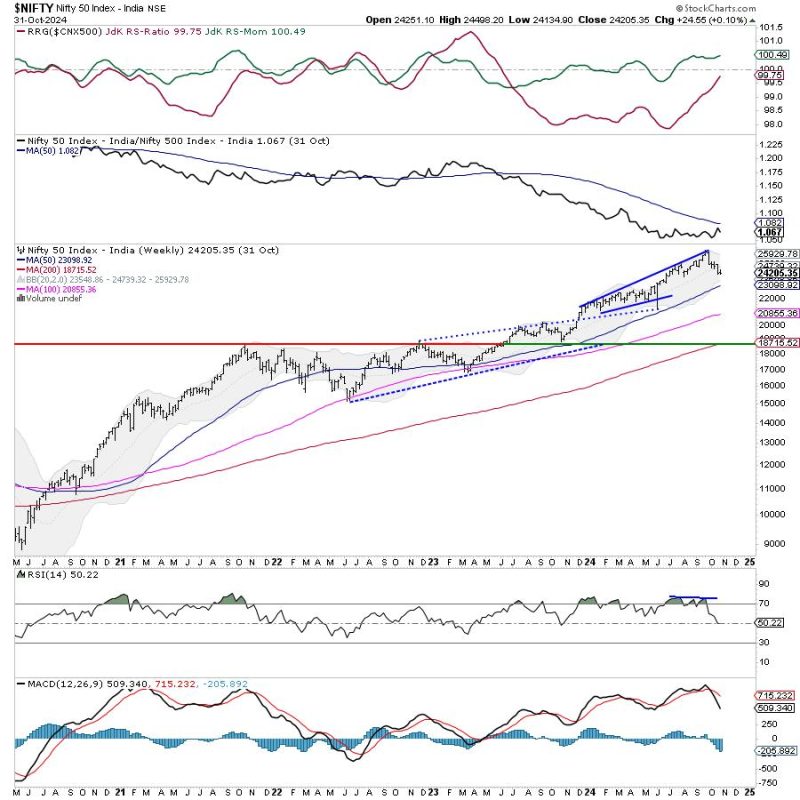

As the week unfolds, market participants will keenly observe key support and resistance levels, seeking to gauge the Nifty’s resilience in the face of external pressures. The interplay of technical analysis and market fundamentals will come to the fore, guiding investors in their decision-making processes as they navigate the choppy waters of the stock market.

In such a dynamic and ever-evolving landscape, adaptability and foresight are key virtues for investors looking to stay ahead of the curve. The ability to anticipate market trends, interpret macroeconomic data, and react swiftly to changing circumstances will be paramount in navigating the complexities of the Nifty’s movements in the week ahead.

While uncertainties may abound and challenges may arise, the Nifty’s resilience and capacity for growth remain unwavering. As investors brace themselves for the week ahead, a blend of caution and optimism may pave the way for strategic decision-making and prudent investments in the face of a market that is as volatile as it is promising.