In a recent article on GodzillaNewz, the discussion around the secular bull market continuing with a major rotation has brought attention to the dynamic nature of the current economic landscape. As we delve deeper into the analysis provided, it becomes evident that investors need to adapt to the changing market conditions and be prepared for the potential shifts in investment strategies that may be required to navigate successfully in this environment.

The article highlights the ongoing secular bull market, indicating a sustained upward trend in the market over an extended period, typically lasting multiple years. This trend has been a source of optimism for investors, offering opportunities for growth and wealth accumulation. However, what sets the current market apart is the major rotation that is taking place within various sectors and asset classes.

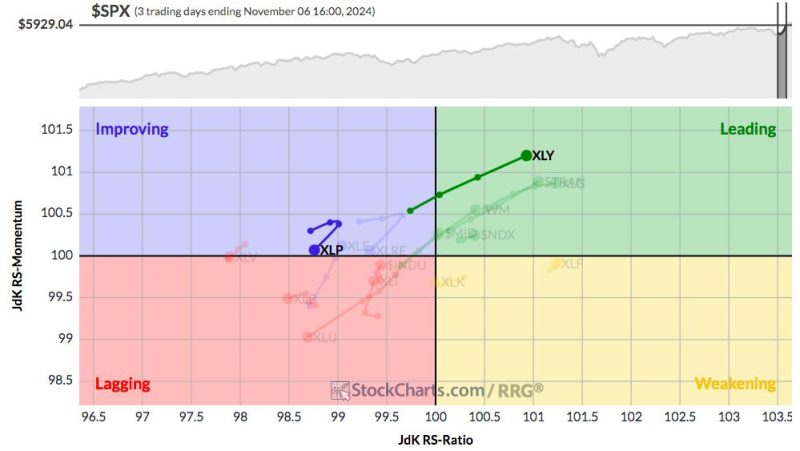

The concept of rotation refers to the shifting of investor preferences from one sector to another based on changing economic conditions, market trends, or other factors. This rotation can significantly impact the performance of different sectors and asset classes, creating opportunities for those who can accurately anticipate and react to these shifts.

One of the key points raised in the article is the importance of diversification in a portfolio to mitigate risks associated with sector rotation. By spreading investments across different sectors and asset classes, investors can reduce their exposure to any single area of the market that may be experiencing volatility or underperformance.

Furthermore, the article emphasizes the need for active portfolio management in response to changing market dynamics. With the current environment characterized by rapid shifts in sector performance, passive investment strategies may not be sufficient to capture emerging opportunities or protect against potential downsides.

Moreover, the article highlights the significance of staying informed about market trends, economic indicators, and geopolitical events that can impact investment decisions. By staying abreast of relevant information, investors can make more informed choices and adjust their portfolios accordingly to align with the prevailing market conditions.

Overall, the analysis presented on GodzillaNewz underscores the importance of adaptability and agility in navigating the current secular bull market with a major rotation. As the investment landscape continues to evolve, investors who are proactive, diversified, and well-informed stand a better chance of achieving their financial goals and weathering market uncertainties. It is crucial for investors to remain vigilant, responsive, and open to adjusting their strategies to capitalize on emerging opportunities and mitigate risks in this dynamic market environment.